KS K-BEN 990 2018-2025 free printable template

Show details

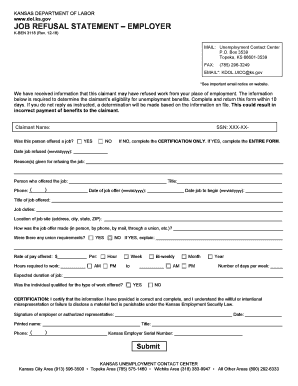

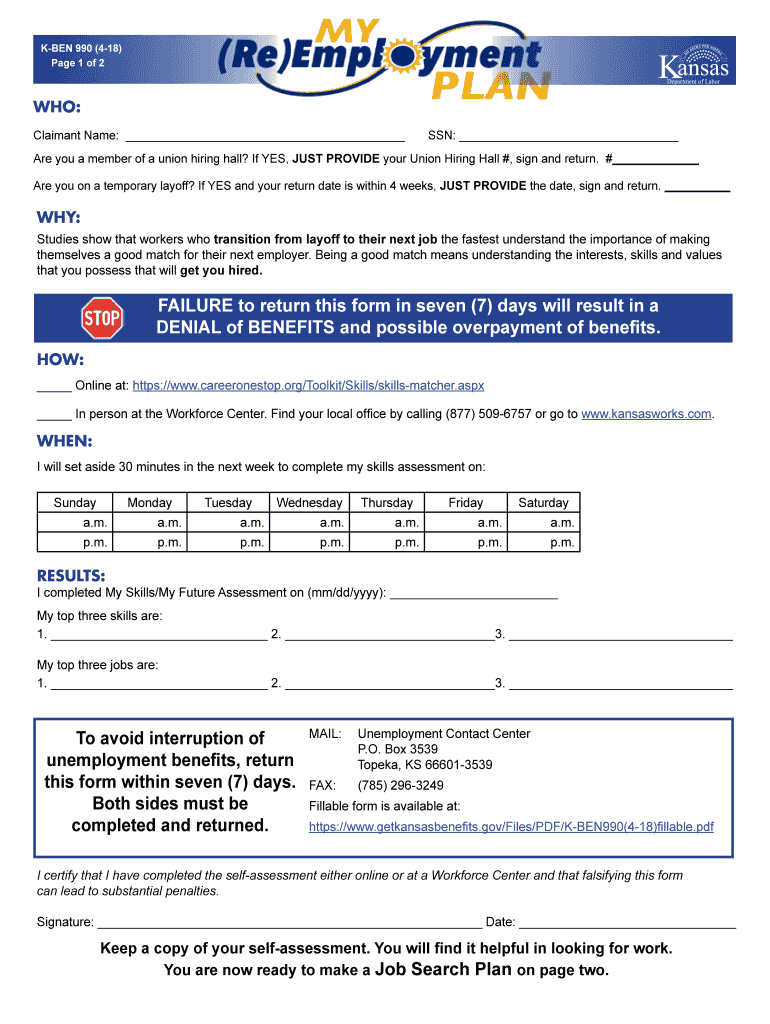

K-BEN 990 4-18 Page 1 of 2 WHO Claimant Name SSN Are you a member of a union hiring hall If YES JUST PROVIDE your Union Hiring Hall sign and return. Are you on a temporary layoff If YES and your return date is within 4 weeks JUST PROVIDE the date sign and return. WHY Studies show that workers who transition from layoff to their next job the fastest understand the importance of making themselves a good match for their next employer. Being a good match means understanding the interests skills...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ben990 form

Edit your KS K-BEN 990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KS K-BEN 990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing KS K-BEN 990 online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit KS K-BEN 990. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS K-BEN 990 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KS K-BEN 990

How to fill out KS K-BEN 990

01

Obtain the KS K-BEN 990 form from the relevant authority or their website.

02

Write the taxpayer Identification Number (TIN) at the top of the form.

03

Fill in the name and address of the applicant in the designated fields.

04

Provide details about the entity or individual that requires the exemption status.

05

Indicate the specific tax benefits or exemptions being applied for.

06

Attach any required supporting documents as per instructions.

07

Review all information for accuracy and completeness.

08

Sign and date the form before submission.

Who needs KS K-BEN 990?

01

Entities or individuals seeking tax-exempt status within the jurisdiction covered by KS K-BEN 990.

02

Organizations applying for specific tax benefits as a non-profit or charitable entity.

03

Businesses wanting to verify their tax status in relation to local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What information do I need to file for unemployment in Kansas?

If filing online - your user name, password and PIN. If filing by phone - your Social Security number and PIN. The amount of your gross wages earned (money earned before deductions, not received) during the week you are making a claim for unemployment insurance.

What qualifies me for unemployment Kansas?

To qualify for benefits you must have been paid wages from insured employment in at least two quarters with the total of your wages being at least 30 times your WBA. Insured work is work performed for employers who are required to pay unemployment insurance tax on your wages.

How much unemployment will I get in Kansas?

Unemployment FAQs For claims filed on or after July 1, 2021, weekly benefit amounts will be between $140 and $560 per week.

What are the requirements to file for unemployment in Kansas?

You must be totally or partially unemployed through no fault of your own, and you must have earned sufficient wages in your base period (the first 4 of the last 5 completed calendar quarters before the start date of your claim). Also, you must be able and available for full-time work.

What is the Kansas unemployment tax form?

In the case of unemployment, the 1099-G documents the total benefits paid to the claimant during the previous calendar year. The same information is provided to the Internal Revenue Service.

What disqualifies you from unemployment in Kansas?

If you return to work full time or have gross earnings (wages before deductions) that equal or exceed your weekly benefit amount, you should stop filing weekly claims, and your claim will become inactive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my KS K-BEN 990 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your KS K-BEN 990 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify KS K-BEN 990 without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your KS K-BEN 990 into a dynamic fillable form that you can manage and eSign from anywhere.

Can I sign the KS K-BEN 990 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your KS K-BEN 990 in seconds.

What is KS K-BEN 990?

KS K-BEN 990 is a tax form used in Kansas for reporting and verifying information about beneficial owners of certain entities.

Who is required to file KS K-BEN 990?

Entities that are registered in Kansas and have beneficial owners, such as corporations and limited liability companies, are required to file KS K-BEN 990.

How to fill out KS K-BEN 990?

To fill out KS K-BEN 990, provide the entity's information, details about the beneficial owners, and any other required financial information, ensuring accuracy before submission.

What is the purpose of KS K-BEN 990?

The purpose of KS K-BEN 990 is to increase transparency regarding the ownership of entities and to aid in the enforcement of laws related to taxation and anti-money laundering.

What information must be reported on KS K-BEN 990?

KS K-BEN 990 requires reporting of the entity's name, address, federal identification number, and details of each beneficial owner including their name, address, and ownership percentage.

Fill out your KS K-BEN 990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KS K-BEN 990 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.